Digital Banking Market Scope and Overview

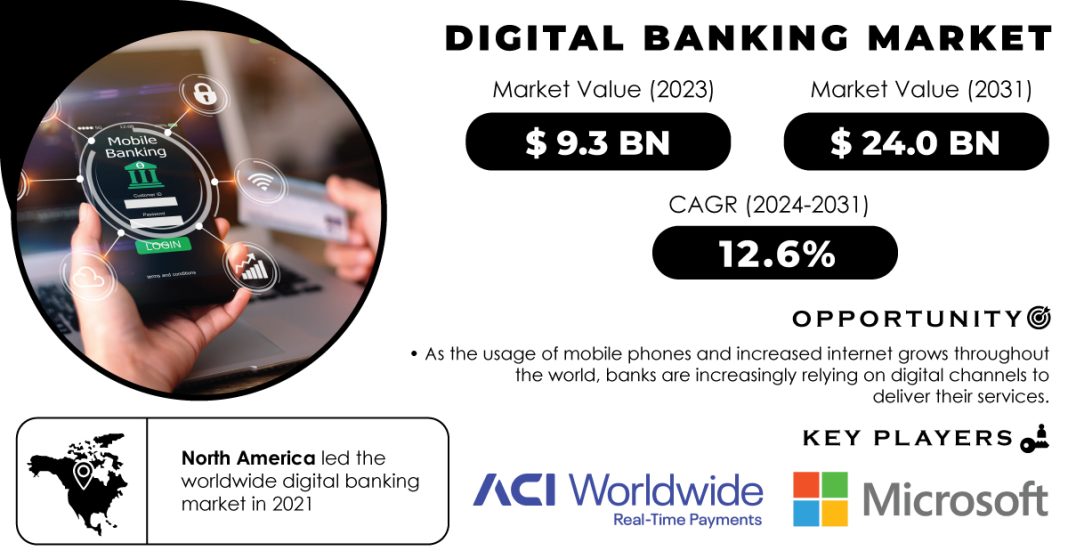

The Digital Banking Market is revolutionizing the financial services industry by leveraging technology to deliver banking solutions that are faster, more efficient, and increasingly user-friendly. As consumer expectations evolve and technology advances, banks and financial institutions are adopting digital platforms to meet the growing demand for convenience and personalized services. This market encompasses a broad range of digital solutions, including online banking platforms, mobile applications, and integrated financial management systems. Understanding the dynamics of this market is essential for stakeholders aiming to stay ahead in an increasingly competitive and technology-driven environment.

The Digital Banking market involves the provision of banking services through online and mobile platforms, allowing customers to perform financial transactions and manage their accounts without visiting physical branches. This market is expanding as more consumers and businesses seek convenient, efficient, and secure banking solutions. Digital banking encompasses a wide range of services, including account management, payments, loans, and investment services. The adoption of digital banking is driven by technological advancements, consumer preferences for digital experiences, and the need for enhanced operational efficiency in the financial sector.

Competitive Analysis

The digital banking market is highly competitive, with a diverse range of key players offering a variety of solutions to cater to different aspects of digital banking. ACI Worldwide and Fiserv are prominent players known for their comprehensive digital banking solutions and payment processing systems. Microsoft Corporation provides robust technological infrastructure and cloud-based solutions that support digital banking operations. Tata Consultancy Services and Oracle Corporation offer extensive software and consulting services tailored to the financial sector.

Temenos Group AG and Cor Financial Solutions Ltd are recognized for their specialized banking software and integrated financial management systems. Rockall Technologies and EdgeVerve Systems Limited contribute with innovative solutions in financial services and digital transformation. Other players in the market provide niche solutions and services that address specific needs within the digital banking ecosystem.

Digital Banking Market Segmentation

The digital banking market can be segmented into several key categories:

By Type

- Informational Services: This segment includes services that provide information to customers, such as account balances, transaction histories, and financial product details. Digital platforms offering informational services are crucial for enhancing transparency and enabling users to manage their finances effectively.

- Transactional Services: Transactional services involve processing financial transactions, such as fund transfers, bill payments, and loan applications. This segment is vital for enabling seamless and secure financial transactions through digital channels, enhancing customer convenience and operational efficiency.

- Communicative Services: Communicative services encompass features that facilitate communication between banks and customers, such as chatbots, customer support, and notifications. These services improve customer engagement and support by providing timely and interactive communication channels.

By Software

- Customized Software: Customized software solutions are tailored to meet the specific needs of individual banks or financial institutions. This segment includes bespoke development of banking systems and applications that address unique operational requirements and customer preferences.

- Standard Software: Standard software solutions are pre-built platforms and applications designed to address common banking needs. These solutions offer scalability and efficiency, making them suitable for a wide range of institutions seeking cost-effective digital banking solutions.

By Banking Type

- Retail Banking: Retail banking focuses on providing banking services to individual consumers. This segment includes personal banking products such as savings accounts, mortgages, and personal loans. Digital solutions for retail banking aim to enhance customer experience and streamline account management.

- Corporate Banking: Corporate banking serves businesses and corporations, offering services such as commercial loans, treasury management, and business accounts. Digital banking solutions in this segment are designed to support complex financial transactions and manage corporate financial operations effectively.

- Investment Banking: Investment banking involves services related to capital markets, mergers and acquisitions, and financial advisory. Digital solutions for investment banking support activities such as trading, portfolio management, and investment analysis, facilitating efficient and informed decision-making.

By Service Type

- Payments: The payments segment includes digital solutions for processing various types of payments, such as credit and debit card transactions, electronic transfers, and mobile payments. This segment is central to digital banking, enabling secure and efficient payment processing for consumers and businesses alike.

- Processing Services: Processing services involve the management and execution of financial transactions and data processing tasks. This segment includes solutions for transaction processing, data management, and system integration, ensuring the smooth operation of digital banking systems.

- Customer & Channel Management: Customer and channel management services focus on optimizing customer interactions and managing multiple communication channels. This segment includes solutions for customer relationship management (CRM), multi-channel support, and customer analytics, enhancing the overall customer experience.

- Wealth Management: Wealth management services provide financial planning, investment advisory, and portfolio management for high-net-worth individuals and institutions. Digital solutions in this segment offer tools and platforms for managing investments, tracking performance, and accessing financial insights.

- Others: This category includes various other digital banking services that may not fall into the primary segments. Examples include fraud detection, regulatory compliance solutions, and financial planning tools that address additional aspects of digital banking.

Strengths of the Digital Banking Market

The digital banking market exhibits several strengths that contribute to its robust growth and development:

- Digital banking platforms offer convenience and accessibility, allowing customers to perform banking transactions anytime and anywhere. The emphasis on user-friendly interfaces and personalized services enhances overall customer satisfaction and engagement.

- Digital banking solutions streamline banking operations by automating processes, reducing manual intervention, and improving accuracy. This leads to cost savings and increased efficiency for banks and financial institutions.

- Digital banking platforms are scalable, enabling banks to expand their services and reach new customer segments without significant infrastructure investments. This scalability supports growth and adaptation to changing market conditions.

- The integration of advanced technologies such as artificial intelligence, machine learning, and blockchain enhances the capabilities of digital banking solutions. These innovations drive continuous improvement and offer new opportunities for differentiation.

- Digital banking solutions incorporate robust security measures and compliance features to protect customer data and meet regulatory requirements. Enhanced security protocols build trust and ensure the safe management of financial transactions.

Key Points Covered in the Market Research Report

The market research report on the digital banking market covers several critical aspects:

- The report provides an overview of the digital banking market, including its size, growth trajectory, and key trends shaping the industry.

- An analysis of the competitive landscape highlights key players, their market strategies, and competitive advantages. This section offers insights into how leading companies are positioning themselves in the market.

- Detailed segmentation analysis covers various categories, including product types, software solutions, banking types, and service types. This section explores how different segments contribute to market dynamics and growth.

- The report identifies key factors driving market growth, such as technological advancements, changing consumer preferences, and increasing demand for digital solutions.

- An examination of regional dynamics provides insights into market performance across different geographical areas, highlighting opportunities and challenges in various regions.

- The report offers projections for future market trends and growth potential, helping stakeholders understand the direction of the market and make informed decisions.

Conclusion

The digital banking market is experiencing transformative growth, driven by technological advancements and evolving consumer expectations. With a diverse range of solutions and key players such as ACI Worldwide, Microsoft Corporation, and Fiserv, the market is well-positioned to meet the demands of modern banking. The segmentation of the market into types, software solutions, banking types, and service categories highlights the breadth of digital banking services available to consumers and institutions.

Strengths such as enhanced customer experience, operational efficiency, scalability, and innovation underscore the market’s potential for continued development. The market research report provides valuable insights into these aspects, offering a comprehensive understanding of the market’s current state and future outlook. As digital banking continues to evolve, stakeholders must stay informed about trends and opportunities to navigate this dynamic landscape effectively and capitalize on the growing demand for digital financial solutions.

Table of Contents

- Introduction

- Industry Flowchart

- Research Methodology

- Market Dynamics

- Impact Analysis

- Impact of Ukraine-Russia war

- Impact of Economic Slowdown on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Digital Banking Market Segmentation, by Type

- Digital Banking Market Segmentation, by Software

- Digital Banking Market Segmentation, By Banking Type

- Digital Banking Market Segmentation, By Service Type

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Project Management Software Market Size

Open Source Services Market Growth

Talent Management Software Market Forecast