Banking as a Service Market Scope and Overview

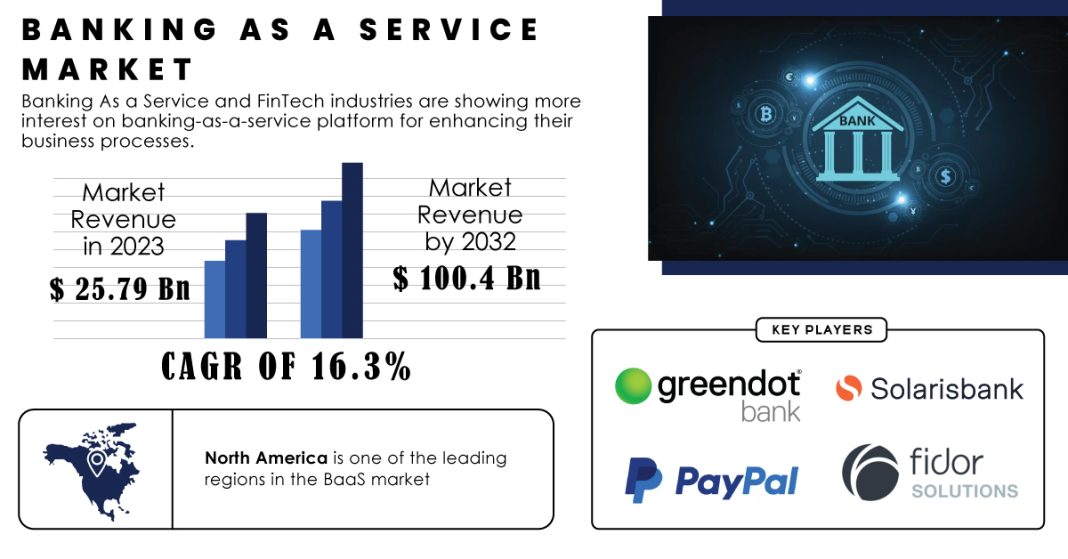

The Banking as a Service Market was valued at USD 25.79 billion in 2023 and is expected to reach USD 100.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 16.3% during the forecast period 2024-2032. This growth is driven by the open banking trend and the democratization of finance systems, empowering non-traditional financial institutions and FinTech companies to leverage established banking infrastructure through APIs, creating innovative financial products and services.

The demand for digital banking solutions is a significant growth driver for the BaaS market. According to data, over 80% of US consumers utilize online or mobile banking services, highlighting a strong presence for digital financial solutions that BaaS platforms facilitate. The number of FinTech startups in North America has grown in recent years, exceeding 10,000 according to some estimates. This shift towards convenient and accessible financial tools is further expanding the market as these FinTechs leverage BaaS to develop innovative financial products and services. Additionally, open banking regulations and strategic collaborations, such as the partnership between Finastra and Microsoft, are fostering a more collaborative financial ecosystem, providing numerous opportunities for BaaS providers.

Key Players Studied in this Report

- Green Dot Bank

- Solarisbank AG

- PayPal Holdings

- Fidor Solutions AG

- Moven Enterprise

- The Currency Cloud Ltd

- Treezor

- Match Move Pay Pte Ltd

- Block

- Bnkbl Ltd

- Others

Banking as a Service Market Analysis: Growth Drivers

Demand for Digital Banking Services: The growing demand for convenient and accessible digital banking solutions is driving the adoption of BaaS platforms. Consumers are increasingly turning towards mobile banking and online financial services.

Emerging Economies: Developing economies in Asia Pacific and Africa present significant growth opportunities for BaaS providers. These regions have a large unbanked population and a growing appetite for financial inclusion.

Focus on Security and Compliance: Regulations and evolving security threats necessitate robust security measures within BaaS platforms. Leading providers are constantly innovating and investing in advanced security protocols to ensure data privacy and regulatory compliance.

Recent Developments and Collaborations

- July 2024: Mambu, a leading cloud-based BaaS platform provider, announced a strategic partnership with Banco ABC Brasil, a major Brazilian bank. This collaboration aims to empower Banco ABC to offer innovative financial products and services to its customers through Mambu’s BaaS platform.

- June 2024: Fiserv unveiled a new BaaS solution specifically designed for credit unions. This solution caters to the unique needs of credit unions, enabling them to compete more effectively with larger financial institutions.

Banking as a Service Market Segment Analysis

By Product Type

The BaaS Market is divided into two primary delivery models: cloud-based and API-based. In 2023, the cloud-based BaaS Market held over 58% of the market share due to its ability to swiftly deliver new digital features, ensuring users have access to the latest functionalities. While cloud solutions currently dominate, the API-based BaaS segment is also experiencing significant growth during the forecast period 2024-2032. APIs function as secure bridges, enabling seamless data exchange between FinTech companies and traditional banks, allowing FinTechs to offer integrated banking services directly within their apps or web interfaces, creating a more convenient user experience. The ongoing efforts of FinTech companies to enhance the BaaS ecosystem, such as Cashfree’s Accounts API launched in September, are expected to propel API-based BaaS solutions forward.

By Component

The BaaS market is divided into two key components: platforms and services. In 2023, BaaS platforms held the dominant position with more than 59% of the market share due to their ability to seamlessly integrate financial services, open accounts, issue cards, and even process loans directly into a company’s existing software. This enhanced user experience, along with benefits like increased brand loyalty and improved product marketing, fuels the growth of the BaaS platform segment. The services segment within the BaaS market is poised for significant growth throughout the forecast period 2024-2032. This surge is a direct consequence of the transformative nature of BaaS, empowering non-bank entities (distributors) to leverage third-party platforms and provide these same products and services to their customers. These services typically include integration, deployment, and ongoing maintenance of the BaaS platform, encompassing cloud storage, database management, hosting, user authentication, and push notifications.

Banking as a Service Market Segmentation and Sub-Segmentation

By Product Type

- API

- Cloud-based BaaS

By Component

- Platform

- Services

By Enterprise Size

- Large

- SME

By End-User

- Banks

- FinTech Corporations

- NBFC

- Others

Regional Analysis

North America dominated the BaaS Market with more than 35% share of the global revenue in 2023, driven by major players like PayPal and Green Dot Bank, which have played a vital role in establishing and propelling the BaaS market forward. These companies continuously introduce new solutions and functionalities, shaping the landscape for other players. Additionally, the regulatory environments in North America are generally more receptive to open banking initiatives, fostering collaboration between traditional banks and FinTech companies, creating an opportunity for the BaaS market to grow in the future.

Small and Medium Enterprises (SMEs) are the backbone of the North American economy. The recent collaboration between Finastra and Microsoft in April 2022 exemplifies this focus. By providing alternative lending solutions through BaaS platforms, SMEs gain easier access to the capital they need. This vibrant FinTech ecosystem drives demand for innovative BaaS solutions. Investments in the BaaS market within North America are also on the rise, with venture capitalists recognizing the immense potential of this sector.

Key Takeaways

- The BaaS Market represents the future of finance, characterized by open collaboration and a focus on customer-centric innovation.

- The rise of open banking and FinTech adoption is fueling the growth of the BaaS Market.

- BaaS empowers non-traditional financial institutions to offer innovative financial products and services.

- The market is driven by the increasing demand for digital banking solutions and the focus on financial inclusion.

- Security and compliance remain important considerations within the BaaS Market.

Table of Contents

- Introduction

- Industry Flowchart

- Research Methodology

- Market Dynamics

- Impact Analysis

- Impact of Ukraine-Russia war

- Impact of Economic Slowdown on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Banking As a Service Market Segmentation, by Product Type

- Banking As a Service Market Segmentation, by Component

- Banking As a Service Market Segmentation, by Enterprise Size

- Banking As a Service Market Segmentation, by End-User

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Cloud Managed Services Market Trends